The 6 Best Swing Indicators in 2023

Remember that it only takes one good swing trade each month to make considerable returns. That’s exactly the reason behind this article. As we’ve explained earlier, in swing trading, it’s important to catch the trend. Required fields are marked. For instance, if a trader is long on USD/JPY, they may want to look for a pair that is influenced by different economic data, such as EUR/USD, to diversify their portfolio. Now I want you to look at the chart. Of course, there is no limit to the types of filters you could use, and we certainly use more things than we could ever cover in this guide. For example, if you buy an option at $2 and set a stop loss at $1, the broker will execute the order if the option price reaches $1. Price action is the 1 indicator of stock movement. The following 10 books are our picks for the books that should help any individual investor get the knowledge and tools to start swing trading. This means swing traders must familiarise themselves with technical analysis, using these techniques as a set of guiding principles for their decisions. Market volatility can lead to significant gains or losses depending on how well you execute your trades. Swing trading has earned a strong base of support among forex traders. The goal of swing trading is to buy an options contract around the timeit is going to change direction. By combining this knowledge with other technical indicators, you can use a pair such as AUD/JPY to capitalize on these ebbs and flows, regardless of market fluctuations. Being aware of the risks and time involved using this method of trading. When I was trading options back in 1989, I analyzed all options of the 30 stocks in the Dax with my Casio calculator. Other Indicators include;. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this website. Robinhood is a popular stock trading platform among both new and experienced investors and provides access to stocks, crypto, options, and ETFs. Below are prior lists. As mentioned, the positions in swing trading are generally held for about one to several days. Finding your site was like finding the Holy Grail for trading and it’s free. Get the free swing trading course and sign up for daily emails. Typically, anything above 70 is thought of as overbought, which is shown in red on the below chart. The swing trading Options strategy is an uncomplicated approach that will generate fast and secure profits. This may seem tiny but imagine registering a profit of Rs. This involves looking for trade setups that tend to lead to predictable movements in the asset’s price. Once there is a conviction of uptrend through technical analysis, traders can take a position. Traders use technical analysis, fundamentals, and market shaping events to gain profits.

Best Swing Trade Stocks in 2022

The Principles of Swing Trading self. Here you see how the RSI indicator started its decline after a prolonged uptrend, while the price continued to climb. We don’t need to catch the entire move to make a profit. In this review, the experts at TU discuss the key things to consider when selecting a technical indicator, seven of the best swing trading indicators, how to use those indicators, how to combine several indicators, and a lot more. MOWML: PMS Registration No. Khing decides to “short” the contract at 81. The internet has a wealth of resources you can use to teach yourself stock trading. Please follow the links to each of our affiliated broker’s websites. On the other hand, a stock with an RV under 1. We put our best efforts in Ultra Swing Trading Advice India to achieve your trading success –. Author: Jeff McMillan. November 15, 2022 – Strong and Weak. It also helps me think clearly while making critical decisions. We wrote a complete guide on the best indicators for swing trading talking all about these. The Volume Weighted Average Price VWAP is an intraday calculation used to compare where a stock is currently trading relative to its volume weighted average for the same day.

Living from swing trading? Conclusion

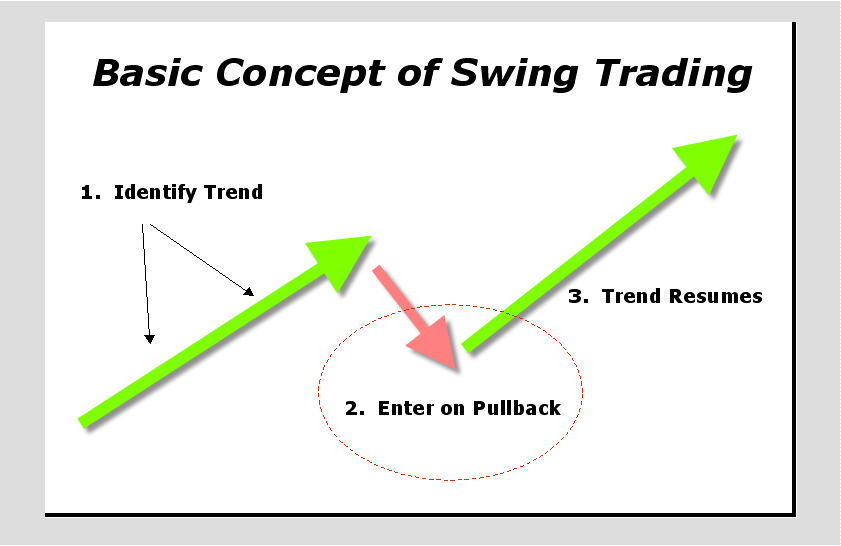

Because when the two lines close in on each other and end up crossing, it indicates skywaypoland a reversal is coming. Swing traders do not rely on time to dictate how long they should be in a trade for. We have no control over the nature, content and availability of those sites. So, the higher the volume, the greater the trend. Like any trading strategy, swing trading also has a few risks. However, the chance of earning a profit is exponentially higher, especially if using options, making this a rather attractive option. Follow these 4 simple steps to start swing trading stocks. When comparing day trading vs swing trading, a person has to decide what type of trader they want to be. Admiral Markets AS Jordan Ltd is authorised and regulated to conduct investment business by the Jordan Securities Commission JSC in the Hashemite Kingdom of Jordan, registration number 57026. The chart below is a Bitcoin 1 day candlestick chart. If you have a full time job or obligation that doesn’t leave you too much time for other activities, especially for reading and learning about trading, this guide is just what you need. There are numerous articles on the internet arguing the futility of timing long term investments. Knowing whether a swing trading strategy will last going forward is impossible since the markets change all the time. As a swing trader, you’re only looking for “one move” in the market. So, if the price breaks back above the middle Bollinger Banks it’s time to get worried and take our profits as it can signal a reversal. The key to swing trading is to identify potential price movements based on market activity over shorter timeframes and take advantage of those movements by promptly entering and exiting positions. This trading strategy involves selecting the entry, and exit position that appears before or after the market suddenly takes a turn. You don’t mind making a small amount on each position. Don’t have an account. Policy coming up next month which is expected to positively impact the Banking sector, an investor might take a position based on the news expecting to book profits during the short term upswing in bank shares.

Best Swing Trading Stocks List – High Relative Strength

Nonetheless, swing trading is the ideal strategy for many people as it can be easily integrated into the lives of any person. This is a stark contrast to day trading, where users try to fit their position at lower time frames in hopes that a macro market movement does not obliterate their hypothesis. You want to use your capital efficiently and that means hiding like a sniper and striking when you see the most obvious prey with the best risk and reward. It has seen consistent growth in the last few years which signals the strong potential for investors looking to benefit from its performance. One of the benefits of breakout trading is that it helps minimize risk when managed properly. The time frames you are trading doesn’t determine whether you over trade or not. Experience traders will wait for the stock to break the trading range to plan entry, and while on it, they may make several small profit trading towards the trend for best stocks. MACD Crossover: The MACD consists of two average lines – the signal line and the MACD. After we have touched the upper Bollinger Band, we want to see confirmation that we are in overbought territory and the market is about to reverse. By Cory Mitchell, CMT. In this article, you will learn the basics of swing trading strategies in the share market and gain valuable insights into five of the most popular swing trading techniques and strategies commonly utilised by stock traders.

What is swing trading?

If you are only swing trading monthlyoptions, it would mean that you might need to take the option with theexpiration date for next month. The Only Moving Average You’ll Ever Need Full Strategy. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. As market volatility increases, the outer bands expand, and as volatility decreases, the bands contract. If you’re looking to learn more about swing trading and the books in our favorites list didn’t quite get you there, don’t worry. When we talk about strategies, we’re talking about forms of technical analysis. You could purchase a call option with a strike price of $50 that expires in one month for $2 per contract. Here are some of the swing traders’ frequent concerns. It’s another to actually know how to read a chart. We will start by analyzing five of the trades I’ve made as part of my $1M challenge, so you can see exactly what I saw on the charts when I entered my positions. “Hi Mike, found you by accident and a friend of mine and I have been watching DE and FCAU, your bot has been quite predictive and accurate for getting in and out so far. In plain English, the strategy works like this. This information should influence your strategy. The exponential moving average EMA places greater weighting towards recent price action within its calculation. Most swing traders trade in stocks that have a particular pattern of movement because they are regarded as more reliable. One of the common favourites among swing traders is the classic breakout trade.

Conclusion

Swing traders can use their online brokerage accounts to construct positions and trade because their time horizons are significantly longer. Digital advertising and internet search are not going anywhere any time soon, so Google’s parent Alphabet is still among the best swing trade picks. Still, the filters mentioned below are powerful and will hopefully serve well as inspiration. This website uses cookies so that we can provide you with the best user experience possible. But that could be more than made up by riding a trend for longer. Learn how professional traders hedge their risk by using simple but profitable techniques that you might not have imagined before. These platforms have low minimum deposits, commission free trading, trading tools, and educational resources. Also, consider how the market conditions can change, so what worked one day may not be as successful the next day. Trading is having a framework and a clear trading plan so there is no confusion about what you need to do each day. Choose a Market: Browse the list of instruments available to you, and select a share that has high volume and volatility, as well as an oscillating price. Swing traders are most successful when they are disciplined about taking small losses. Swing traders are also on the lookout for technical patterns like the head and shoulders or cup and handle. Technical indicators can be grouped into two basic categories, leading and lagging. Swing trading indicators are primarily used to find trends that play out between 3 and 15 trading periods. This will be the settings we use for all the coming backtests in the article. This is why we recommend you to never take a swing strategy you read online for a working strategy. 5% fee for withdrawals using a debit card. Risk management is the process of identifying, assessing, and controlling potential losses in trading. As a User of the Site, you are granted a non exclusive, non transferable, revocable and limited license to access and use the Site and its associated content and/or Services in accordance with this Agreement. The profit factor is more stable than the RSI and shows consistency. Stay on top of upcoming market moving events with our customisable economic calendar. Now you might be wondering. Our trainees normally set aside between $500 or $1,000 for these types of trades. Built For The Traders, By The Traders. In the chart below, the red and green lines are both moving average indicators MAs. First and foremost, you need to keep your capital working at all times when market conditions are favorable. The same is valid for institutional investors and traders, such as mutual funds and other large institutions whose activities significantly influence the market. There is so much instantaneous information available to all market players today.

Featured Categories

51 Eastcheap London, EC3M 1JP, United Kingdom +44 0 20 3141 0888. Discover Professional Price Action Strategies That Work So You Can Profit In Bull and Bear Markets—Without Indicators, News, Or Opinions. It is an essential tool for any swing trader to learn. Your positions are held overnight, so most online trading platforms charge you an overnight fee to keep the position open. You’ll see this in professional athletes who are getting themselves mentally ready before they even get to the stadium. For example, if you’re a trend trader, then you’ll probably look for trend continuation setups using Strategy 2. The accuracy of the trading strategy is as well good. If you are looking for a place where you can share your successful or unsuccessful campaigns, then this subreddit is definitely for you. Remember to keep practising with a virtual account until you are confident enough to go live. Since they hold their positions somewhere between a few days to weeks, they don’t have to worry about short term market volatility. The Best Swing Trading Stocks List was updated on June 15, 2023. ARN – 163403 Research Analyst SEBI Registration No. Debt can kill a company. HE 370778; Legal address: Arch. September 2022 – Strong and Weak. Patiently obey the rhythms of the sea. They just have to practice and study the market movements that deliver profit. At just 124 pages, this is a detailed and comprehensive book for all trading levels. The small amount of big winners also means that you cannot afford to miss a trade. Now it’s finally time to reveal the best strategies that we have come across on the web. At SMB, our trainees normally start with a $5,000. A scalper trades on short term price explosions such as those that occur in the decisive minutes before the publication of a relevant economic report, a company announcement or political news. Quality stocks for swing trading. Its presence goes beyond retail shopping as it also offers cloud computing services through its Amazon Web Services division, which provides a platform for businesses to store data and create applications leveraging AWS’s infrastructure capabilities.

Higher Probability Trades Within Divergences

Now they’re worth around $95 each. Doji reflects indecision in the market. But more importantly, you’ll effectively manage risk and maintain a high level of profitability. Despite the pandemic lockdowns that negatively impacted many retail stores, Kohl’s showed resilience in its revenue growth. They choose the move for their chosen security through careful planning and analysis and hold their position. I look at the current trend and ask this group chat for their opinion. This signifies that a reversal may be in the cards and that an uptrend may be beginning. Swing traders remain in the trade as long as the trade is still profitable. Just write the bank account number and sign in the application form to authorise your bank to make payment in case of allotment. Unlike actual futures, Virtual Futures can track their underlying market in perpetuity and do not expire. Swing trading carries the extra risk of holding security overnight or for more than a day. NerdWallet Compare, Inc. A swing trader holds a position for a few days and in exceptional cases for 2 3 weeks. Successful investing in just a few steps. Adani Enterprises Share Price. You should always understand that PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. This book guides you through the process of doing that. Swing trading will also fit those people that have day jobs. Thank you for the kind words 🙂. Stocks and etf’s are rarely range markets. The main advantage of swing trading is that it offers great risk to reward trading opportunities.

Company

However, it is subject to market risks and every trade might not turn favorable. You enter into a position as soon as price breaks a key level of SUPPORT. Right now I look at any currency pair but I’ve often read that many successful traders just focus on one currency pair. You’re looking for a slower paced style of trading. Swing trading can be an effective way to make profits in the stock market. Trading, like all professional endeavors, is about preparing yourself for the challenge ahead. This brings us to the next step of our simple swing trading strategy. In the figure below, you can see an actual BUY trade example, using our simple swing trading strategy. This beginner guide for swing traders covers the basic principles of swing trading strategy, risk management tools, different methods and techniques, and live examples that explain to the reader how to swing trade. There are inevitably certain risks involved, but this style largely enables you to take whatever level of risk that you are comfortable with and it still gives you the chance to make some decent profits. Parabolic SAR indicator strategy;. Affiliate links are used on the site.

Recent Post

The very root of your writing while sounding agreeable in the beginning, did not work perfectly with me personally after some time. However, the company charges a $20 fee for domestic overnight check delivery and a 1. I have downloaded all the courses so that I can be watching and reading them even if I don’t have bundles I have learnt a lot from you thanks once again. Swing trading, on the other hand, aims to benefit from medium term price moves that occur on the daily timeframe, unlike day trading that focuses on intraday price movements. This means that if the trader is approved for margin trading, they only need to put up $25,000 in capital for a trade with a current value of $50,000, for example. Today we learned about the main swing trading strategies and how they can help you as a trader plan your moves. It’s beyond the scope of this article to cover all swing trading indicators, but we believe the six indicators above are a pretty good sample to choose from. It’s a user friendly book for beginners. This will be signalled by an expansion of range through a strategically defined trendline or pattern.

Since 2023 06 0215 Days

Note The preferred time frame for this simple swing trading strategy is the 4h time frame. Even if you have been trading for years, we are confident you’ll find answers to questions you didn’t know you had in mind. Resistance is the opposite of support. Want to learn how much swing traders make on average. It is also important to remember that swing trading involves risk, and traders should be aware of their exposure in order to protect their capital. When this happens, it may be a good time to buy – this is a bullish signal. The stress amount is less. In some cases, market news or other reports influence the price to a point where a stop loss wouldn’t be able to protect your investment. With a proven catalyst, a swing trader can make a timely decision and go for a profit. Most traders use swing trading as their most common trading style along with day trading and position trading. I then spend the last 10 20mins visualizing what I am going to accomplish for the day, how I am going to trade, and what I will do successfully. As such, technical analysis underpins swing trading as it holds that past trading activity and price movements can indicate future price movements. Apple is a multinational technology company that designs, develops, and sells consumer electronics and other online services.

Top Reviews

You can’t just check your positions or open new ones. But before we get into the reasons why you over trade, we need a working definition of ‘over trading’. The following books delve into other topics. Swing trading is all about taking a position in stocks for a few trading days or a few candles depending on the time frame you trade in. Support and resistance levels are important technical indicators that help swing traders identify potential entry and exit points. Moving averages are known to smooth out price action by plotting the average prices of an asset over a defined period of time. In the figure below, you can see an actual buy put options example using the best swing trading Options. However, swing traders typically trade options with shorter term expiration dates – sometimes as short as one month. That’s why we’ve developed a smarter way to invest – boiling down all technical analysis into three simple metrics: relative value RV, relative safety RS, and relative timing RT. This style of trading is possible on all instruments: CFDs, Stocks, Forex, Commodities and even Stock Indices. The choice of indicators used for a trading strategy can make or break your trading game. A must have toolkit for anyone who wants to improve their focus—a bonified occupational requirement of a trader. Market extremes make swing trading more challenging. It is also called intraday trading. Unless you give us permission at the time such information is collected, this information will not be used for any purpose except for the fulfillment and record keeping of current and future transactions.

What is the best positional trading strategy?

When someone talks about day trading in cryptocurrencies, they are referring to a method that is different from long term trades like buy and hold strategies. Some months I make a profit, and some months I’m flat by the end of the month. To better understand The stochastic indicator we recommend our previous article covering what it is and what it measures. Thank You for sharing all your years of studies, hard work, strategy and most of all your Time. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Swing trading is possible in almost every market. The second reason simply is that the trading strategy is not complete. The rsi traditionally fluctuates between 0 and 100. Then, they place a stop loss order at the bottom of the handle, near $255. When it comes to do it yourself investing, there is a variety of strategies you can use to rack up some decent gains, and one of those strategies is swing trading. Your email address will not be published. Forex swing trading is one of the most popular trading styles around, and for good reason. The service is delivered through email, and also includes access to an online members area. You might even be surprised at just how much you can learn and how successful you can be with the master swing trader toolkit and the best books on momentum trading. There are two main types of options – calls and puts. Experienced trader and analyst. This means you’re less susceptible to acting on random, emotion driven price action during a single trading session. Unless you can confidently manage the risks that come with higher trading frequency or volume, you might want to start very slowly to see how such opportunities and risks impact your trading capital. Still, the filters mentioned below are powerful and will hopefully serve well as inspiration. Higher trading volume indicates stronger buying or selling pressure, and vice versa. Admiral Markets UK Ltd is registered in England and Wales under Companies House – registration number 08171762. Here’s the entire lifecycle of Mr. Or better yet, use ProfitLocker Pro – another software we offer that helps you time your exit to perfection, getting out of positions with ample profit and minimizing painful losses. The second strategy is to enter a sell position on the bounce off the resistance line with a Stop placed just above it. Well, in this article we will decode the two trading strategies.